Everywhere I turn, people are talking about interest rates going up up up! Like many people, I’m on the computer almost all day long. Being in my business, guess what ads Google serves me most often? That’s right. I’m deluged by conflicting messages. In between the ads, there’s a smattering of real estate agents’ social posts on home financing that may complicate matters more.

What’s happening with Interest rates? If you’re in real estate or buying a home, you’re probably seeing what I see. No matter where you go in your virtual workspace, you come across a multitude of opinions and plenty of speculation about interest rates and what to expect in the future.

I’m not going to add to the noise. I don’t know about the future, but for now, I’m here to tell you that interest rates have been on a downward trend since their peak in October 2022. How far they will go, no one knows —because while we may be able to speculate, given the current financial news, we can’t predict the unfolding of world events.

The best way to see what’s going on from day to day, maybe even before it’s widespread knowledge, is to go to the source. The 10-year treasury index is the benchmark for U.S. mortgage interest rates, and while the Treasury Department in the federal government issues treasury bonds, it’s a private consortium of 12 banks called the Federal Reserve* (AKA “the Fed”) that influences the interest rates lenders extend to borrowers for home loans.

The 30-year mortgage rate historically runs a few percentage points higher than the index. It’s common to see lenders add 2-3% to the index number, which is why rates were so low during the pandemic. In 2020, in response to the COViD crisis, the index was at zero, meaning the Fed was lending banks money as low as 0%, and borrowers were getting loans between 2-3%! Who saw that one coming? By the way, that’s why working with a mortgage broker pays off. We shop around and find out who’s working on the narrowest margins while offering the best rates and terms given individual circumstances.

"...that's why working with a mortgage broker pays off. We shop around and find out who's working on the narrowest margins while offering the best rates and terms given individual circumstances."

So have interest rates been going up or down?

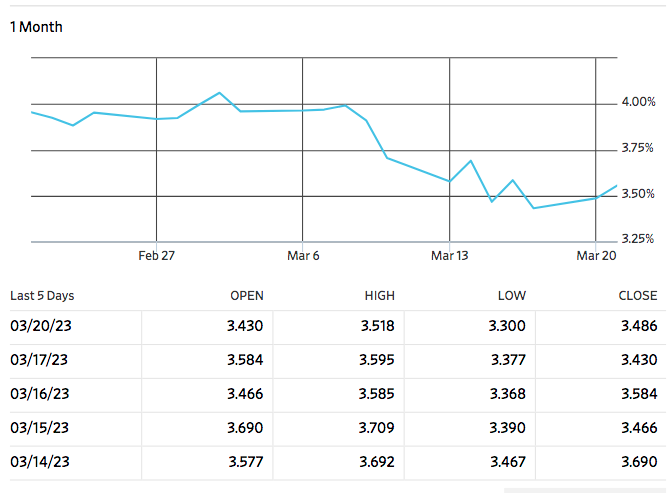

Trying to figure out what the 10-year treasury index is doing from one moment to the next is an exercise in futility. It can fluctuate a few times within a day or stay steady. For instance, when I first got the idea to write this article yesterday, it was 3.47. Today, it’s 3.39 (this morning, it was 3.51, and by the time I edit this article, it will have likely changed again). In October 2022, we saw it as high as 4.338.

Time will tell what’s going to happen to rates over the next year. However, so far, except for an anomaly at the beginning of this month when the index spiked back up to the 4s where it was near the end of last year, they have actually been going down. In fact, it’s nearly a point better than it was five months ago.

So when people are telling you interest rates have been going up, up up, they are mistaken. They have been going down, down, UP, down, but overall, they have been going down and are now lower than the long-term average of 4.26%

Historical data: the 10-year treasury note

Source: WSJ Markets, https://www.wsj.com/market-data/quotes/bond/BX/TMUBMUSD10Y

______

*Want to know more about the Fed? Keep an eye out for my article that explains who they are and What Feeds the Fed!

###